Rider bond rating falls, while outlook stabilizes

By Jake Tiger

Rider’s financial situation gained another layer of complexity on Feb. 1 when its creditworthiness took another hit, but a positive change in its outlook could be indicative of the university’s post-pandemic slide coming to an end.

Moody’s Investors Service, a major global credit rating and risk assessment provider, downgraded Rider’s issuer and revenue bond ratings from B3 to Caa1, the university’s fourth demotion since 2020; simultaneously, the agency upgraded Rider’s outlook from negative to stable due to the university’s reduced scope and steady enrollment, according to the full Moody’s report on Rider’s finances.

Debt ‘double whammy’

Moody’s attributed the downgrade in bond rating to Rider’s $119 million in outstanding debt, ongoing operating deficits and severely limited cash on hand, according to the report.

Bharat Sarath, an accounting professor at Rutgers University, said that Rider should be able to survive in the short term with a bit of “good luck,” but there is a greater problem with the university’s outstanding debt.

“When the interest rates go up and your rating is downgraded, then you’re going to get a double whammy on the interest rates,” said Sarath. “It will be a struggle for a few years, but hopefully, without another pandemic or something like that, they will be able to pull through.”

Investors use credit ratings to assess the likelihood a debt will be paid back, so a worse rating restricts the types of loans Rider can take out and causes increased interest rates.

According to Moody’s long-term rating definitions, obligations graded in the Caa category are of poor standing, subject to very high credit risk and considered to be junk/non-investment grade. Of 21 possible grades, Caa1 is the fifth lowest ahead of Caa2, Caa3, Ca and C.

“I don’t know that anyone is shocked by it necessarily, but it’s certainly disappointing,” said Quinn Cunningham, president of Rider’s chapter of the American Association of University Professors. “There appears to be such a lack of interest in including the faculty in the recovery process, other than trying to just have us cut whatever we possibly can.”

The AAUP twice voted no-confidence in Rider President Gregory Dell’Omo, last doing so in February 2022 when it asked for his removal, with its main complaint being yearly program budget cuts and a lack of raises.

Enrollment rises

Budget reductions have been a universitywide obstacle, but the university has also resorted to cutting positions to chip away at its deficit. Rider’s Path Forward included the elimination of more than 30 positions, saving the university approximately $2.5 million.

After analyzing Rider’s audit for fiscal year 2023, Sarath said, “It seems that the management is taking steps to correct [its deficit], and one of the things I saw is that the salary for employees has fallen. … They must have laid off people.”

In the April 2023 Moody’s report, when Rider fell to a B3 credit rating, the firm said a return to stability would be a challenge given “the magnitude of projected deficits, the inflammatory environment and projected flat enrollment in 2023.”

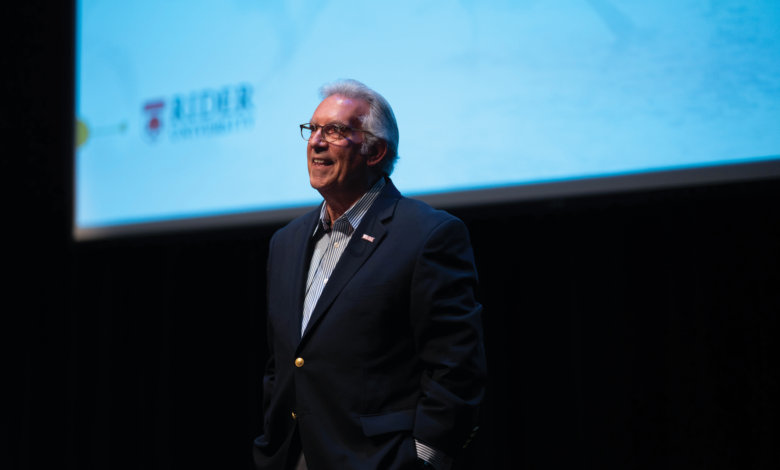

According to Dell’Omo, Rider has seen an increase in enrollment during fiscal year 2024, with approximately an 8% to 9% increase in freshmen and transfer students.

“We hit those numbers, then things look good; when you don’t hit those numbers, that’s when things don’t look as good,” said Dell’Omo in an interview with The Rider News on Jan. 25. “You try to get that balance between being sort of aggressive and trying to push yourself to get as many students here as possible, but … you don’t want to create budgets that are just unrealistic. You’re going to fall short.”

Dell’Omo claimed Rider met all financial goals outlined in its Path Forward plan for the fall semester.

The projections, detailed in Rider’s August 2023 convocation, totaled at least $2.91 million in revenue from enrollment/room and board, student parking fees, Rider First Day, the sale of the West Long Drive house and more.

“The first year of the Path Forward, based on the fall numbers, all hit our targets,” said Dell’Omo. “If the spring plays out the way we planned, and so far, we’re looking like we’re going to hit the spring numbers … this first year of the Path Forward is going to be a success.”

The university began fiscal year 2024 with a goal of reducing the $15.9 million budget to $7.2 million via universitywide reductions and revenue enhancements.

According to Dell’Omo, Rider’s financial plan was a bit ahead of schedule as of Jan. 25, and the university could begin fiscal year 2025 with a deficit just above $6 million. The university aims to eliminate the deficit entirely by the end of that fiscal year.

The administration is hoping Rider will be operating at about a $5 million to $6 million surplus by fiscal year 2026, and that is when the community can expect substantial reinvestment back into the university, Dell’Omo said.

“We are feeling confident that we will come down to a balanced budget next year, which is a tremendous success for the university,” said Dell’Omo. “Going forward, the plan is the plan.”