FAFSA fiasco’s effect on Rider’s enrollment

By Jake Tiger

Hoping to recover from an unforeseen pandemic, Rider instituted its three-year “Path Forward Plan” in July 2023, which aimed to steer the university back to a positive revenue stream.

However, like many other institutions across the country, another unexpected obstacle has knocked Rider off course.

“We’ve never seen anything like this before. This is totally uncharted waters,” said Rider President Gregory Dell’Omo in an April 16 interview with The Rider News.

Month-long delays with the new Free Application for Federal Student Aid, also called the FAFSA, are currently stymying Rider’s enrollment, one of its primary revenue sources, as the university takes another hit while still reeling from the COVID pandemic.

‘A perfect storm’

The U.S. Department of Education rolled out the redesigned FAFSA in December 2023 that was supposed to make the process easier, but the new system and cascading delays have created an unprecedented, nationwide nightmare in higher education.

“History helps us predict the future … There is no comparable year,” said Vice President for Enrollment Management Drew Aromando. “In the administration, there is apprehension that it could be a perfect storm.”

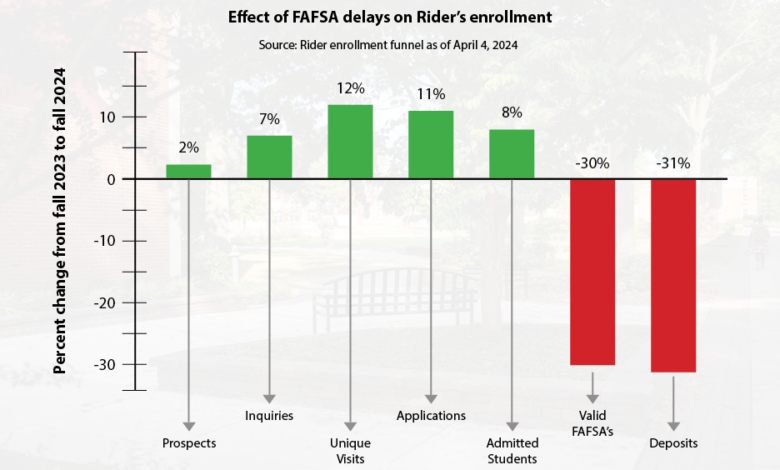

Rider’s fall 2024 enrollment was trending upward prior to FAFSA setbacks, with unique visits, applications and admitted students all up by at least 8% from the year prior, according to administrative data from April 4.

However, as soon as the FAFSA entered the equation, Rider’s numbers dropped by 30% compared to last fall, receiving about 1,500 fewer valid FAFSAs due to the technical issues, according to the data from April 4.

In February, Aromando said Rider’s undergraduate deposits were down 24% from the previous year; as of April 4, that number had dropped to a 31% decrease.

Rider pushed back its deposit deadline to June 1, and Aromando said on April 22 that he expects that number to rise from -31% as the date approaches. He stated that the university typically sees about 50% of its tuition and housing deposits submitted in the three weeks leading up to the deadline.

Aromando said the university is largely unable to push the deadline back any further, as June 1 is already putting Rider right up against the start of its new fiscal year on July 1.

Rider started sending out the first batch of financial aid offers on April 15 to the 40% who had valid FAFSAs, which was about 1,800 admitted students, according to Aromando.

The other 60% of FAFSAs were rejected either due to errors by the filer or technical glitches in the new system. Rider will send out offers to those people as they receive their updated and approved applications, Aromando said.

On April 22, Aromando said the university had sent out offers for all of the satisfactory applications, which was about 39% of all FAFSAs – valid or not.

He noted that, in a normal admissions cycle, Rider would have sent out about 3,300 (65%) more offers at this point.

Rider is ahead of many other institutions on dispersing financial aid packages, but Aromando said this likely won’t offer much of an advantage in enrollment, as most students will still wait to hear back from every school they applied to.

The university is about six months behind where it should be, and Aromando described the situation as “embarrassing.”

“There is no reason why they shouldn’t have had everything in order for October 1, 2023, but they started missing deadlines,” said Aromando. “They just did not really do what needed to be done.”

National trends

The USDOE has seen FAFSA filing decrease by 29% nationally and by 21% in New Jersey, according to Aromando, which could certainly ding Rider’s precious enrollment.

High school students who file their FAFSA are 84% more likely to pursue higher education, according to research from the National College Attainment Network that Aromando included in his email to Rider’s staff and faculty.

Aromando said Rider and the USDOE have increased reminder communication with students to encourage them to file. Rider has also started calling students who have not yet submitted their FAFSA, urging them to do so.

Dell’Omo said, “We live and die on tuition revenue and housing revenue. If you’re off by whatever percent, that immediately goes to the bottom line impacting the resources we have to run the university, and that’s our big concern.”

Financially, enrollment is critical to Rider’s longevity as a private, tuition-dependent institution. If there is a year with a dip in enrollment, that lack of revenue is felt for four years, Aromando said.

“The worry is, are families just waiting till they get the information, and they make a decision and the numbers come right back up,” Aromando said, “or is this going to be a pandemic year where they just kind of go away?”

The drop in filings correlates with learning loss stemming from the COVID pandemic, as the incoming class of university students began high school in fall 2020 when many schools were still using remote or hybrid learning.

According to Harvard’s graduate school of education, test scores have declined across all populations since the pandemic with grades three through eight specifically losing half of a year in math progress and a quarter of a year in reading.

The New York Times reported in November 2023 that the COVID generation of students has also seen significant increases in absenteeism and mental health difficulties, each hampering academic growth.

“It’s hard for us to sit back and watch this unfold,” said Aromando. “It’s one thing when a pandemic has taken your ability to do your job effectively out of the equation. … It’s another thing when it occurs because the U.S. Department of Education has not done their job.”