Tax forms show Dell’Omo’s deferred compensation

By Amethyst Martinez

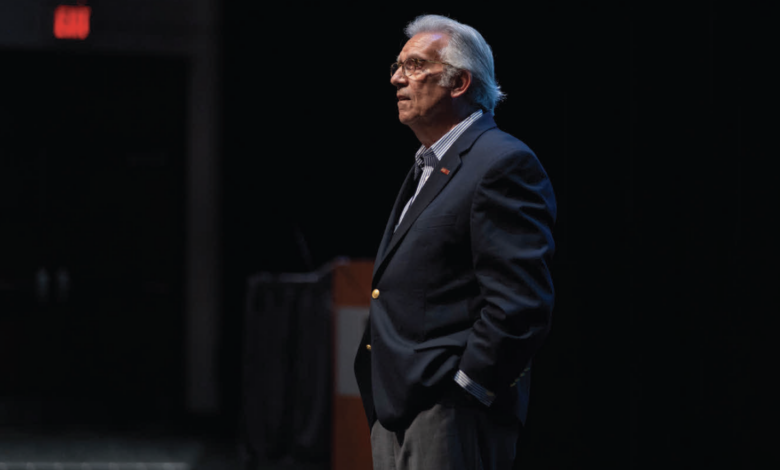

Rider President Gregory Dell’Omo received an undisclosed amount of deferred compensation in the school’s most recent tax forms, but, like many of the university’s employees, he will be taking a reduction in retirement compensation this year, according to the school’s chief financial officer.

Dell’Omo, Rider’s highest-paid employee, earned $661,936 in salary and benefits in 2021-22, the highest level since he joined the school in 2015, according to the tax forms. Over his years at the helm, Dell’Omo has repeatedly stressed Rider’s precarious financial position and the university’s bond rating has plummeted.

CFO James Hartman, who was listed as the third highest paid employee in the tax forms, declined to say what Dell’Omo’s deferred compensation was. In August, Dell’Omo announced that non-union workers’ retirement benefits would be slashed from 5% to 2.5% due to the school’s “dangerously uncertain” financial position, and Hartman said in an email to The Rider News that Dell’Omo would follow suit. This month, Rider’s unionized support staff agreed to a similar retirement cut but Rider’s faculty union members refused to give up any retirement benefits after years of stagnant wages.

Hartman declined an in-person or phone interview with The Rider News regarding the president’s finances.

Rider’s most recent tax forms unveiled a multitude of differences regarding its finances from the past year’s filing, as the university has made numerous cuts from retirement slashes to staff layoffs due to its economic struggles.

According to the forms, Dell’Omo’s salary and benefits amounted to a $56,420 jump from the 2020-21 tax form to the most recent.

In the fiscal year that spans from July 1, 2021 to June 30, 2022, the president’s salary and benefits amounted to $661,936, with the previous tax form totaling to $605,516. The prior form featured administrator pay cuts due to the COVID-19 pandemic, where Dell’Omo took a 25% voluntary cut from May to October 2020, and a 15% cut from November 2020 through June 2021, according to Kristine Brown, associate vice president for university marketing and communications.

Via email, Hartman said that outside of the president’s base salary, which amounted to $569,702 in the most recent tax filing, the president’s benefits included payment for a life insurance policy, disability insurance, a car allowance, use of the house on Lawrenceville Road adjacent to campus and deferred compensation. The benefits cost the university an additional $92,234 to his base salary.

In the 2019-20 fiscal year tax filing, Dell’Omo’s salary and benefits amounted to $620,112, according to university tax forms.

Hartman blamed the sizable increase on the “value of non-salary-based benefits,” which he explained as salary reductions and deferred compensation. Hartman refused to disclose the amount of deferred compensation, or what the money was from.

Retirement percentages

According to Hartman, in 2021-22, the year of the most recent tax returns, Dell’Omo had a 5% retirement contribution. The new reduction in retirement benefits went into effect on Sept. 1.

Before the semester began, Rider’s chapter of the American Association of University Professors said the university — in year two of a five-year contract — was asked for $1 million back.

This came after lengthy contract negotiations between the university and the faculty union and the threat of a fall 2022 faculty strike, before a new contract was ratified on Sept. 11, 2022.

On Sept. 11, 2023, the union announced members voted against authorizing the AAUP Executive Committee to enter negotiations regarding the requested concessions.

“I think part of the reason that some of the membership may be unwilling to even enter discussions is that we had a really awful negotiation period only a year ago,” said AAUP President Quinn Cunningham in an interview with The Rider News.

Although the university did not go into specifics with the union on what the $1 million back over the next two years could mean for members, Cunningham said that it was assumed that it would be the 2.5% retirement cut that non-union employees received in September.

Faculty layoffs for low-enrollment programs were hinted at in a summer webinar by Dell’Omo, with Cunningham saying that it could be on the horizon. In order for faculty to be laid off, the administration would have to let the union know by Oct. 31.

After the union informed the university of the vote rejecting new concessions, Robert Stoto, vice president of human resources, responded to the union, saying, “Understood. We will proceed accordingly, and pursue whatever cost reductions are necessary, given ongoing financial developments, through channels available within the collective bargaining agreement.”

In 2017, Moody’s Investors Service revised Rider’s outlook from stable to negative. Three years later in 2020, Moody’s downgraded the university’s revenue bonds to “junk” status. In 2021 and 2023, the rating declined further, according to Moody’s Investors Service.

Originally printed in the 9/13/23 issue.